In 2016, voters in San Francisco, Alameda and Contra Costa county approved a $3.5 Billion dollar bond to keep BART moving. Funds from the bond will be used to replace aging infrastructure throughout the system, but even three and half billion dollars will scarcely keep us running in place. Maintaining what we have long term—and eventually improving on what’s already in place—means finding a sustainable revenue stream for the system and reimagining how we fund transit in the Bay Area.

Hong Kong vs the Bay

Putting BART on permanently firm financial footing doesn’t mean reinventing the wheel. Commuter rail systems in East Asia figured out how to run profitably decades ago. And there’s no better example of what BART could be than the Metro Transit Railway Corporation (MTRC) in Hong Kong.

The MTRC operates 130 miles of track (roughly equivalent to BART). It transports over 5 million passengers a day (about 10x BART’s daily ridership). And it posts a 99.9% on time rate (let’s just say…way the hell better than BART).

The MTRC is able to maintain its first-in-class service levels because it doesn’t skimp on the upkeep. It employs approximately 5,000 technicians who physically inspect every inch of track once every three days. The rolling stock is given a similar level of attention. And the entire system is overseen from a state-of-the-art control center where management can identify problems in real-time. The result of all this preventative care is a transit system that reliably performs at scale and sets the global standard for commuter rail.

All told, the MTRC spends an impressive US $700 million a year on maintenance and improvements. But perhaps the most amazing thing is that this $700 million comes out to less than 40% of the MTRC’s yearly revenue.

Value Capture Finance

The MTRC has two major revenue streams. The first is its ticket sales which drive enough revenue to cover operational costs. The other is the value generated from its real estate holdings around each of its stations. This is where the MTRC makes the bulk of its money and is how it manages to foot the bill for constant maintenance and reinvestment.

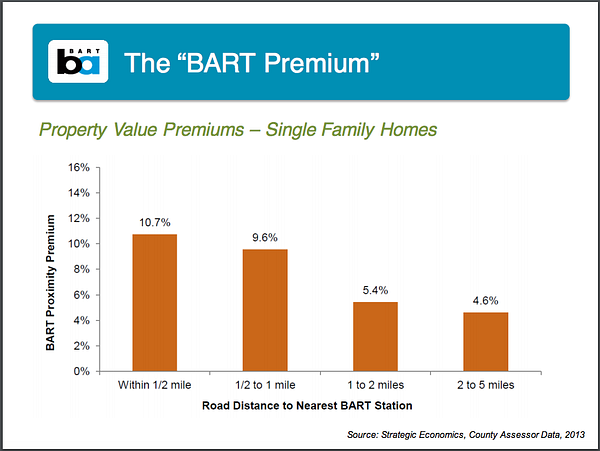

Real estate benefits from high quality mass transit. To whatever extent people are willing to pay a premium to be closer to transit, rental prices will be that much higher. In the Bay Area, private landholders with properties near each station internalize this windfall. But in Hong Kong, the MTRC is the property owner around each of its stations and this allows it to recapture that added value to reinvest back into the system.

Copying the MTRC 1:1 is, unfortunately, not an option for BART. Hong Kong operates under a leasehold system of land tenure which means…well, TL;DR it was easy to endow the MTRC with property around each of its stations.

In the Bay Area, we would have to use taxation to recoup the value that BART creates for property owners. And due to everyone’s favorite constitutional amendment, this is a legal and political non-starter. There is, however, another way forward.

BART owns acres of surface parking spread out across the system. If it were to redevelop these parking lots into high density, mixed use developments, it could copy the MTRC model and create a high yield stream of revenue.

There would, of course, be other benefits as well. The entire region needs more housing, so every extra unit of additional housing would help. Concentrating development on top of transit nodes would also mitigate congestion on our roadways. And if BART were able to influence development around its network, it could redirect passenger load in directions where the system has slack capacity.

Fortunately, BART (along with Caltrain and the VTA) has every intention of implementing this plan. The biggest barriers to execution, however, will be local resistance to development. BART won’t be able to approach financial self sufficiency if it can’t put its land holdings to better use. And it will never be able to put those holdings to better use if hyper-parochial concerns continue to take precedent over the future of the region.

BART can be better. And while it has a lot to work on, the first step is ensuring it has the resources to do its job. There’s a clear path toward financial viability and it’s up to all of us to support the agency as it tries to walk that path. In the short run, that means keeping the lights on (thank you measure RR supporters). Longer term, that means holding our elected officials on the BART Board accountable for execution and backing them up in the face of NIMBY recalcitrance.

Required Reading:

The Integrated Rail-Property Development Model in Hong Kong: In depth analysis of the MTRC model from Hong Kong Polytechnic University